The Financing Process

Your Financial Road Map

Let the True North Group Connect You with a Lender

By collaborating with a trusted lender and remaining informed through every step of the process, from pre-approval through closing, you can have a significantly more comfortable experience. If you don't already have a lender, the True North Group partners with Reach Home Loans and can help you connect.

Get Pre-Approved

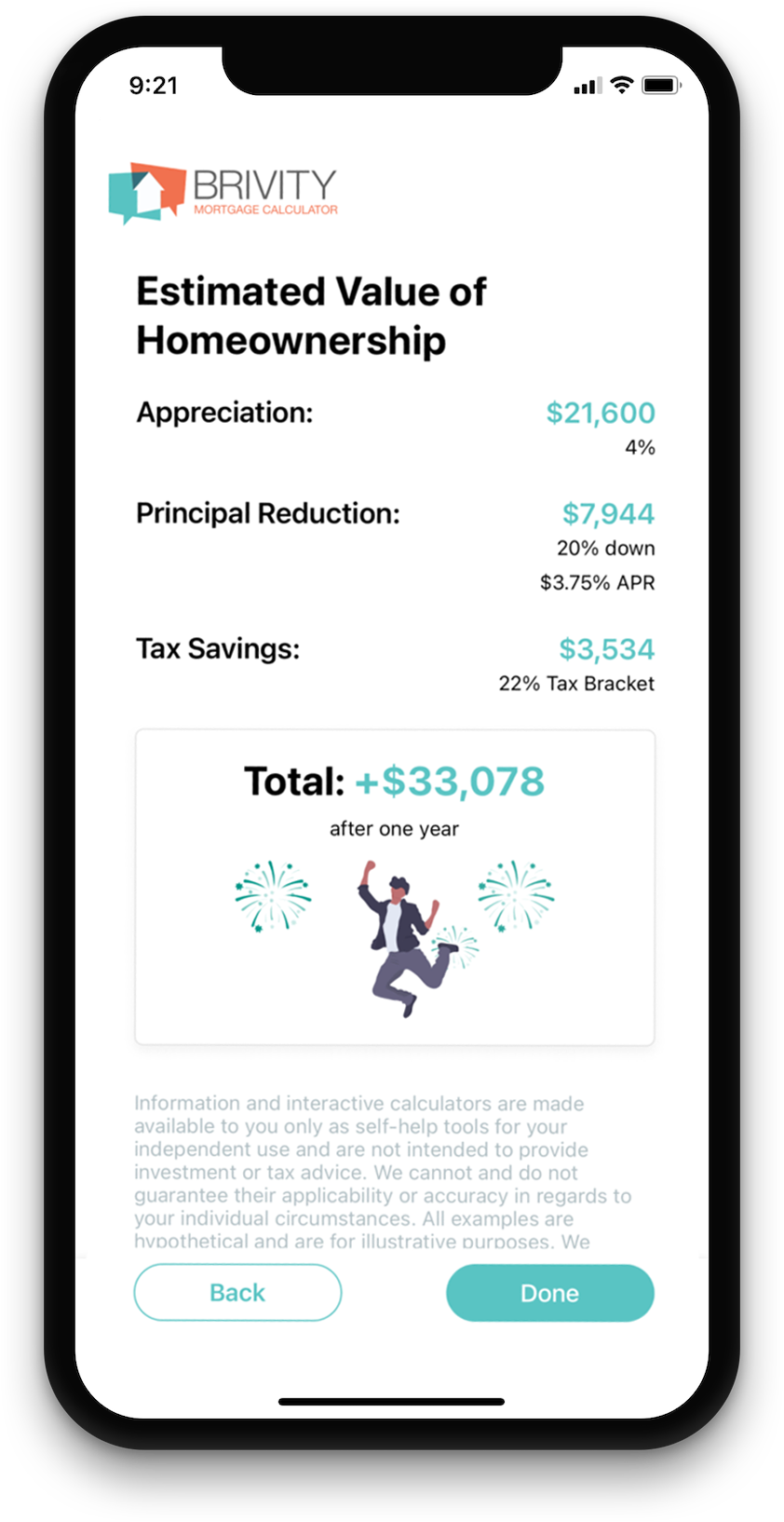

Determine your ideal lifestyle and budget, taking into account your income, expenses, debts, and future financial goals. This includes not only future property appreciation and the mortgage payment but also property taxes, homeowner's insurance, home maintenance costs, and tax deductions.

What is it?

A Pre-Approval letter provides price guidance, estimated payments, and closing costs. A lender will review your finances to determine what you are comfortable with.

Documents Needed to Apply

- Most recent two years of W2s

- Most recent 30 days of pay stubs

- Most recent two (2) months of asset statements including checking, savings, retirement accounts, etc.

- Most recent mortgage statement and insurance bill, if applicable

Loan Types

Conventional - Allows for as little as 3%-5% down when you’re a first-time buyer purchasing a primary residence. You can also use this loan type to purchase a second, vacation, or investment property.

FHA - Allows for 3.5% down and can only be used to purchase a primary residence. Note that you do not need to be a first-time buyer to obtain an FHA mortgage.

VA - Allows you to purchase a home with no money down if you are an active-duty military personnel, veteran, or spouse of a deceased veteran and eligible.

Bank Statement - Allows a lender to review your personal or business bank statements to determine your income. This is a great option for self-employed individuals.

Debt Service Coverage Ratio (DSCR) - Allows an investor to purchase an investment home without verifying income or employment. Instead, the market rent for the property is reviewed to make sure it will cover the monthly payments for the home.

Estimate Your Monthly Payment

Estimate your mortgage payment, including the principal and interest, taxes, insurance, HOA, and Private Mortgage Insurance.

Price

Annual Tax

Loan Term (Years)

Down Payment %

Interest Rate %

Monthly HOA

Monthly Insurance

$3,198.20

Estimated Monthly Payment

Principal

$2,398.20

(75.0%)Taxes

$500.00

(15.6%)HOA

$100.00

(3.1%)Insurance

$200.00

(6.3%)Find the Best Loan Option

Collaborating with a top-notch local loan officer will ensure you have access to competitive rates and programs that best fit your individual needs. Take the first step by completing this form to get connected today!

Application and Processing

When you find the perfect property and your offer is accepted, your lender will help you complete a full mortgage loan application, discuss down payment options, and explain any related fees.

Then, your application is submitted for processing where the documents are reviewed. Your lender will also order a home appraisal and a property title search.

The next part of the application process involves sending everything to an underwriter who will review and approve the entire loan package to make sure it meets all compliance regulations.

It is not unusual to receive requests for additional documentation or

clarification during this phase of the application process.

Signing and Finalizing the Deal

Once your loan is approved, you’ll need to set up homeowners insurance.

Your documents will be sent to the title company and the closing will be scheduled for you to sign the necessary paperwork and pay any additional costs to complete the purchase of your new home.

After the loan goes through the required recording process, the purchase is complete, and you officially own your new home!